Four Airports, Two Banks: Air India Reshapes Hub Strategy

Air India is set to implement significant changes to its international widebody network starting early next year, following its recent merger with Vistara. This merger has added seven Dreamliners to Air India’s fleet but has also presented challenges, particularly with overlapping flights to key destinations like Frankfurt, Paris, and London Heathrow. While the adjustments are still a work in progress, they are expected to take effect in early February, although further changes may occur.

This restructuring marks the first major overhaul of Air India’s international network under the Tata Group, which has been focused on reinstating flights to Europe and expanding connections to destinations such as Mumbai-Melbourne and San Francisco from Bengaluru and Mumbai. Additionally, Air India has launched short-haul flights to cities like Ho Chi Minh City, Phuket, and Kuala Lumpur.

Changes to Key Routes

Paris-Mumbai

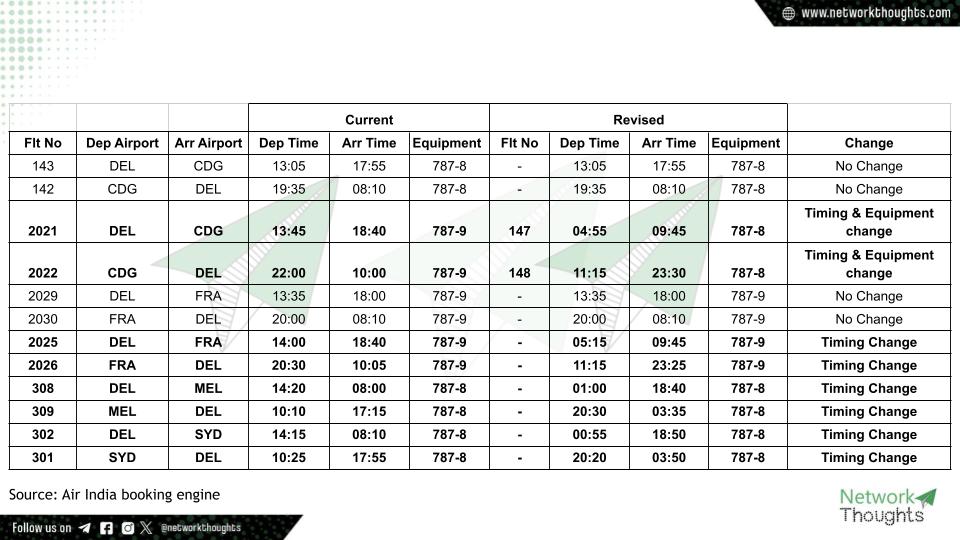

As part of the merger, Air India inherited Vistara’s routes, including the Delhi-Paris and Mumbai-Paris services. However, the Mumbai-Paris route has been discontinued. The Delhi-Paris flight has been retimed to depart in the early morning and arrive in Paris at 09:45. The return flight will leave Paris at 11:15 and reach Delhi at 23:30. Notably, the aircraft for this route will be a 787-8, eliminating the premium economy option previously available.

Frankfurt

Frankfurt remains a priority for Air India, and the airline has retained both flights to Frankfurt using the 787-9 Dreamliner. One flight departs Delhi at 05:15, arriving in Frankfurt at 09:45, while the return flight departs Frankfurt at 11:15 and reaches Delhi at 23:25. Former Vistara aircraft will be used for both the Delhi and Mumbai-Frankfurt routes, ensuring a consistent three-class service.

Enhancements to Australia Connections

A significant change involves Air India’s flights to Australia. Previously, midday departures from Europe to Australia led to inconvenient layovers for passengers. The new schedule allows for quick 90-minute connections from Paris and Frankfurt to Melbourne and Sydney. Passengers traveling from Australia to Europe will have shorter transit times, ranging from 65 to 80 minutes. This adjustment gives Air India a competitive edge over other one-stop options via Singapore or Dubai.

These revised timings also benefit passengers traveling beyond Frankfurt and Paris. They create more opportunities for connections with codeshare and interline partners. This strategic move enhances Air India’s pricing power and connectivity to destinations like Singapore, Australia, and Thailand.

Revenue Opportunities and Future Plans

The changes made by Air India were anticipated and practical, despite the challenges of implementing them mid-season at global airports. The airline has successfully adjusted its international flight schedule, addressing routes to major cities like Paris, Frankfurt, and London, as well as making timing changes to flights to Australia.

Air India aims to secure more flight slots at London, particularly at Heathrow, and may consider expanding services at Gatwick if necessary. The focus will be on maximizing flights in existing routes rather than launching new ones unless slots are available.

The successful execution of these changes depends on effective coordination among various operational departments. It includes airport operations and ground services, particularly at Delhi airport, which is currently at full capacity for transit passengers.

Attention is drawn to potential new flights departing from Delhi between 1:00 PM and 2:30 PM. This time frame has historically been crucial for Air India as it develops its hub. But space for additional flights may be limited. The loss of prime slots is uncommon since they typically get reassigned rather than vacated, leaving uncertainty about which airline might take over any available slots in the future.

Four Airports, Five Sectors, and 57 Flights: Air India Strategy to Enhance Metro Flights

In India’s aviation sector, Vistara—an airline born from a joint venture between Tata Group and Singapore Airlines—merged with Air India last month. This merger marks a transformative moment for both airlines, raising questions about service standardization, operational efficiency, and competitive positioning in a crowded market.

Addressing Service Level Concerns

As the merger approached, concerns emerged regarding the differing service levels of the two airlines. Vistara has built a reputation for premium service, while Air India has historically faced challenges related to customer experience. In response, Air India outlined a plan that would allow Vistara’s aircraft and crew to operate flights under a dual branding strategy, where Vistara’s operations would carry a special “2” prefix on flight numbers until early 2025. This was intended to provide continuity for passengers who had come to expect Vistara’s level of service, even as the two brands integrated.

Interestingly, on the merger’s first day, confusion arose as a few flights operated with legacy Air India aircraft but still adopted the “2” prefix, highlighting the complexities involved in merging two distinct brands.

Network and Schedule Changes

Just weeks after the merger announcement, Air India took decisive action to restructure its metro network. The three-class configuration of former Vistara aircraft is now primarily deployed on five key sectors. The routes are Delhi–Mumbai, Delhi–Bengaluru, Delhi–Hyderabad, Mumbai–Bengaluru, and Mumbai–Hyderabad. These changes, effective December 1, 2024, also included altering flight schedules to prevent overlap and confusion among passengers.

For example, on the high-demand Delhi–Mumbai route—where Air India now leads in capacity and frequency—timings for seven flights in each direction were adjusted. Previously, there were instances of two flights departing simultaneously for Delhi from Mumbai at 11:50 AM. Now, these flights have been spaced out by at least 45 minutes, aimed at reducing congestion and streamlining operations. Meanwhile, on the Delhi–Bengaluru route, the second busiest in India, Air India adjusted seven out of 18 departures to optimize schedule spacing.

Operational Challenges and Strategic Moves

Implementing changes across 119 daily flights in this network is no small feat, particularly at congested airports like Delhi and Mumbai. Altering flight schedules requires not only precision but also negotiation for airport slots, which are scarce. The airline’s ability to achieve these adjustments indicates a strategic use of its slot portfolio, which is typical for large airlines operating at hub airports.

According to Cirium, an aviation analytics company, Air India has made progress in spacing out flight schedules. However, there was a slight decrease in overall capacity due to the cancellation of a red-eye flight. This indicates the airline’s careful balancing act between improving passenger experience and managing operational viability.

Balancing Act: Revenue and Competition

The long-term implications of the merger remain to be seen. Air India has inherited Vistara’s stronger market positioning, but it must also navigate the competitive landscape where multiple airlines vie for dominance on popular routes. The new schedule aims to mitigate issues where flights to the same destination could occur almost simultaneously, which complicates pricing strategies and passenger choices.

The integration of Vistara’s fleet provides opportunities for Air India to enhance its offerings. For instance, the standardized services under the “Fly Early” initiative will ensure that passengers receive consistent service levels across all flights in the same cabin class. This uniformity aims to build customer trust and loyalty in the merged entity.

Conclusion: A Path Forward

Air India has faced challenges recently, but the merger with Vistara offers a chance to rejuvenate its operations. By refining schedules and leveraging its larger fleet and combined airport slots, the airline can gain a competitive edge.

Looking ahead, Air India stands at a pivotal juncture. The next few seasons will be critical as the airline works to optimize its network and adapt to market demands. The effectiveness of its strategies will largely determine whether it can capitalize on this merger to improve revenue and customer satisfaction or if it will struggle against established rivals like IndiGo.

As the integration progresses, industry observers will closely monitor Air India’s ability to align its operational practices with passenger expectations. The success of this effort will be crucial in transforming the airline into a formidable competitor in India’s bustling aviation market.