GMR vs Adani: Forget India’s airline battles; who will win the airport battle?

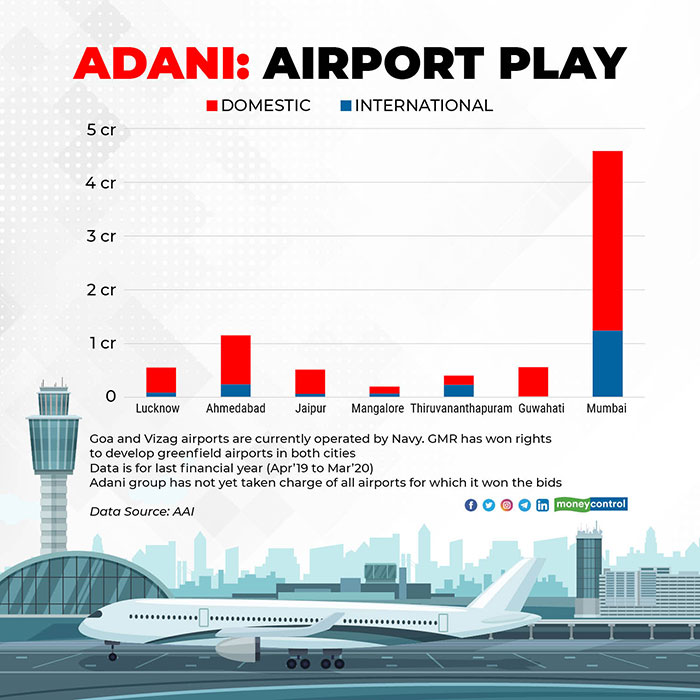

After the airline battle in India’s skies, a battle for airports is brewing down on the ground. From having a private airport at Mundra to winning bids for six airports and then check-mating GVK to bag Mumbai and Navi Mumbai, Adani airports has started making a mark. While the Ahmedabad, Lucknow and Mangaluru airports have been handed over by state-owned Airports Authority of India (AAI) to the Adani group, the others remain in the pipeline.

Privatisation of airports has not been a popular concept in India in the past, with the lone private airport at Kochi. Then came the first wave: privatisation of the Mumbai and Delhi airports, along with construction of greenfield airports at Bengaluru and Hyderabad. The first round was a draw between the GMR group and the GVK group, with GMR bagging Delhi and Hyderabad, while GVK got Mumbai and Bengaluru.

A decade later, GVK is out of the game, having sold its stake in Bengaluru International Airport Limited to Fairfax and cashed out of the Mumbai airport and the Navi Mumbai one to Adani Airports.

Adani and GMR: how do they stack up?

The Adani group seems to have entered the business with a bang, wanting to create a flutter as India aims to become the third-biggest aviation market in the world over the next couple of years.

The Adani group has won rights to operate Lucknow, Ahmedabad, Jaipur, Mangaluru, Thiruvananthapuram and Guwahati. These airports accounted for 9.62 percent of India’s International passengers in the last financial year and 9.74 percent of India’s domestic traffic. Add Mumbai to the mix and the Adani group would suddenly be staring at 28.19 percent of International traffic and 21.95 percent of domestic traffic.

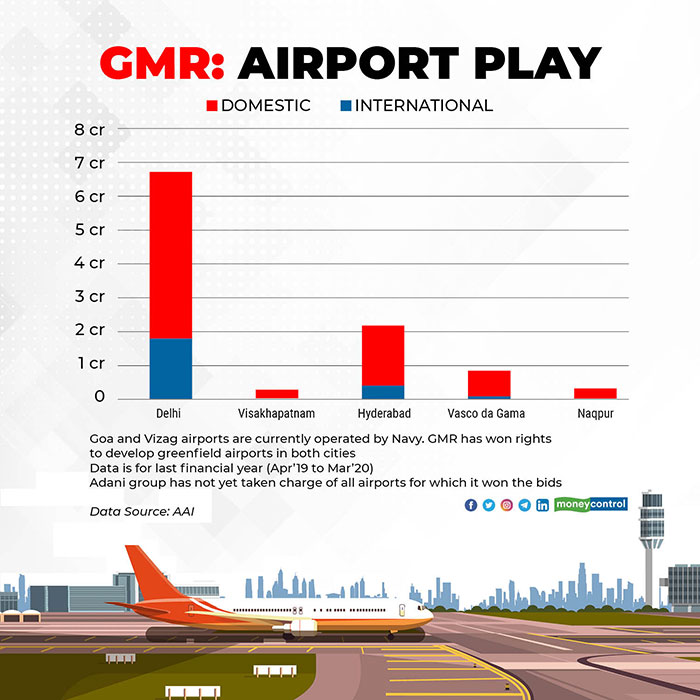

The GMR group, on the other hand, is operating the Delhi International Airport, which is India’s largest by area, passenger footfall, runways and connectivity. Along with Delhi, the group also operates Hyderabad and Nagpur and has won the rights to build and operate airports at Mopa in Goa and Bhogapuram, which will serve Visakhapatnam.

There has also been a special arrangement for operations at Bidar in Karnataka since it comes within a 150 km radius of Hyderabad, where the current contract does not allow another airport. Bidar, however, has limited potential as well as connectivity.

A comparison of traffic in the last financial year shows that GMR’s airports or cities handle 34.13 percent of international traffic and 29.27 percent of domestic traffic. Removing the numbers for Goa and Visakhapatnam, which are currently not operated by the GMR group, the numbers are neck and neck with airports won by the Adani group, which have 32.86 percent of international traffic and 25.55 percent of domestic traffic.

The catch?

While the numbers clearly show GMR group in the lead, there is a catch for both. The GMR group is seeing headwinds for its project at Mopa, with earlier deadlines not being met due to litigation. Besides, the existing airport at Goa will continue to operate, which will lead to a division of traffic between the two. The current Dabolim airport is located centrally, while Mopa is located in North Goa. Likewise, Bhogapuram airport is a few years away and as of now the passenger numbers cannot be stacked in favour of GMR.