Indigo’s foray in Cargo Business(Good News for Aviation)

Cargo Business in India has huge potential. Currently only BlueDart is the only Cargo Carrier in India which has dedicated aircrafts for Cargo.

The huge requirements for AirCargo, is calling the foray of many airlines to start with dedicated freighter aircrafts and frieght divisions.

Low cost carrier Indian airline IndiGo Airlines has tied up with Heavyweight Air Express (HAE) as its general sales agent (GSA) for the Gulf region, as part of its move to aggressively grow its cargo business between the Middle East and India.

“We are now focusing on growing our freight business and Middle East is a very important region for us in this drive. We have recently changed our GSA in the region and picked HAE as our new GSA for the region,” Willy Boulter, chief commercial officer of IndiGo.

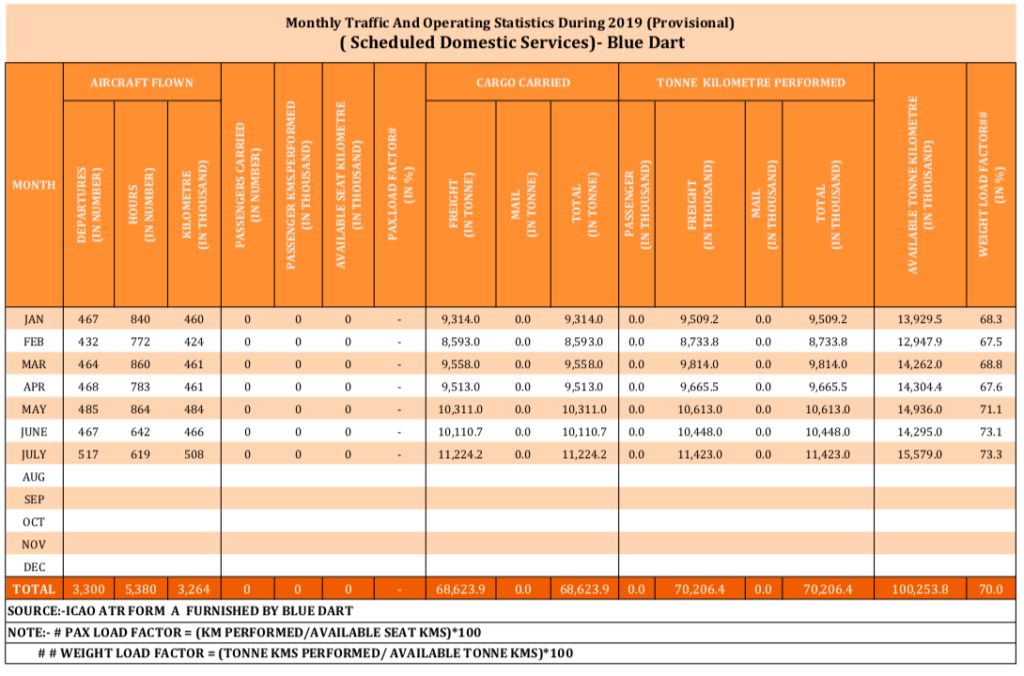

India’s only cargo airline Blue Dart carried a whopping total of 68,623.9 tonne from January till date.

India is one of the fastest growing economies of the world. India currently ranked 44 in 2018 as against 54 in 2014 in the latest Logistics Performance Index by World Bank.

Germany ranked No.1 in Logistic Performance Index in 2018.

INTERNATIONAL LPI

The LPI is an interactive benchmarking tool created to help countries identify the challenges and opportunities they face in their performance on trade logistics and what they can do to improve their performance. The LPI 2018 allows for comparisons across 160 countries.

It is a matter of great importance to India as better performance in logistics not only boosts initiatives like Make in India, by enabling India to become part of the global supply chain but also helps to increase trade.

According to the 2017 Agility Emerging Markets Logistics Index, India climbed to the second position in the 2017 Index, switching spots with UAE. China, the world’s second-largest economy, again topped the rankings.

India’s growing economy and willingness to adopt new reforms has invited major investments to India and have led to the entry of new airlines and launch of new destinations by existing airlines.

The Indian air cargo sector is poised to undergo significant growth in the coming years. The international and domestic freight traffic have shown growth of 10.8 percent and 7.0 percent respectively resulting into overall increase of 9.3 percent in total freight traffic.

Another initiative to uplift the Indian freight industry and making it the foremost integrated logistics network operator with primary focus on air freight handling, Airport Authority of India has launched a subsidiary company, AAI Cargo Logistics & Allied Services Company Limited.

With a bigger and better version, the 7th edition of AIR CARGO INDIA aims to be a perfect platform for global air cargo industry stakeholders to explore India as the best emerging market in the world.

Air Shipper Forums, one of the unique initiatives launched during Air Cargo India in 2014, have become bigger and more popular over the years both in Air Cargo India and Air Cargo Africa events. They are integral to both these events. These forums bring shippers to the heart of the conversation and provide them the right platform to interact with the rest of the stakeholders in the air cargo value chain, including industry and government regulators.

The Centre unveiled its much-awaited national air cargo policy, which seeks to make India among the top five air freight markets by 2025, besides creating air transport shipment hubs at all major airports over the next six years.

The policy document released during the two-day Global Aviation Summit 2019, which kick started here Tuesday, stated that the policy will encourage code sharing/inter-line agreements between foreign and Indian carriers.

As per the policy, international cargo comprises 60 per cent of the total air cargo tonnes handled in the country, logging a growth of 15.6 per cent in the previous fiscal, while domestic cargo grew by over 8 per cent, which reflects the skewed modal mix, in which roads account for over 60 per cent of cargo transportation as compared to the global average of around 30 per cent.

Indian express industry is one of the fastest growing markets globally, but with a small share of about 2 per cent of the global market, grew at a compounded annual growth rate of 17 per cent over the past five years and was estimated to be Rs 22,000 crore in 2016-17, it said.

The domestic express industry, a key constituent of the Indian express industry, is estimated to be worth Rs 17,000 crore, the policy document said adding that the international express is estimated to contribute Rs 5,000 crore to the Indian express industry.

As per the document, the potential in the new markets needs to be explored with long-term infrastructure creation in order to sustain cargo growth in the next 10-15 years at least.

The cargo policy also seeks to establish agreements between national carriers/ freighters and integrators to improve domestic connectivity as well as encourage the establishment of agreements between national and international carriers/freighters and other airline operators to provide access to key global cargo hubs.

It also aims to promote the development of a last mile/first mile connectivity program at international/regional gateways, as per the document.

As part of the security strategy under the policy, the strategy will address security related to the physical cargo, people handling the cargo, data and information related to shipments within and across all chains of custody transfers, it added.

To increase process transparency while decreasing shipment delays, costs and dwell time, a fully automated paperless trade environment with minimum face-to-face interactions will be implemented, as per the policy document.

The policy covers all three categories of air cargo transport – domestic cargo to ensure efficient flow of goods across India; international cargo facilitating all indigenous export and import of goods; and transit international cargo by making India the transit cargo hub of choice to and from other parts of the globe.

The Goods and Service Tax (GST) and other economic legislation to be reviewed by the appropriate government agencies to ensure effective measures are in place to support the national air cargo development strategies, among others, the policy document said.

Aviation industry analysts said IndiGo’s decision to go with HAE to boost its cargo business in the Middle East region is likely to be lucrative given the latter’s extensive knowledge of the Middle East market and its comprehensive network in the region.

Cargo business currently accounts for 4-5 percent of the Indian budget carrier’s overall revenue.

“We want to increase the share of the cargo business in our overall revenue significantly in the coming years,” Boulter said, without giving any specific target or timeline for the proposed growth plans.

Aviation industry experts said cargo is a highly profitable business for airlines in terms of revenue per ASMs (available seat miles).

Boulter said IndiGo’s focus is on achieving higher revenue per available seat per kilometres (ASKs) rather than achieving higher passenger load factor (PLF).

Though IndiGo tops the list among Indian carriers in terms of market share (47.8 percent in July ‘19), it’s third in terms of PLFs at 86.2 percent (July), below SpiceJet (92.4 percent) and Go Air (90.4 percent).